Most mechanic’s lien disputes do not arise in situations where the contractor has substantially completed work and the homeowner is refusing to pay without explanation. Far more often, they arise in moments of tension, when the homeowner questions charges that seem disconnected from the contract, the timeline, or the actual work performed. The contractor responds defensively, insists the invoice is accurate, and when pressed, threatens a mechanic’s lien.

By the time the lien is filed, the homeowner typically has already noticed troubling discrepancies: hours that do not match work observed on-site, materials charged that never appeared at the property, upgrades that were never discussed, or lump-sum totals that bear no resemblance to the payment schedule originally agreed to. Overbilling is not incidental. It tends to emerge when a project is behind schedule, when workmanship problems have surfaced, or when the contractor is trying to recover losses unrelated to the homeowner’s project.

Under those conditions, the lien becomes less a tool to secure legitimate payment and more a pressure tactic to force acceptance of a bill the homeowner knows is inflated. Yet Colorado law does not allow contractors to secure inflated invoices with the power of a lien. A mechanic’s lien must reflect the real value of labor and materials that genuinely improved the property—not a number the contractor hopes to collect simply because the lien process creates leverage.

For homeowners unfamiliar with lien fundamentals, it may be helpful to begin with Understanding Mechanics Liens in Colorado: A Homeowner’s Guide and return here for an in-depth discussion of inflated billing.

Why the Mechanic’s Lien Statute Demands Accuracy

Colorado’s mechanic’s lien statute, C.R.S. § 38-22-101 et seq., is strict in what it allows contractors to claim. A lien is permitted only for the value of labor performed and materials actually incorporated into the property. This requirement sits at the heart of lien law. The statute protects contractors from not being paid for real improvements; it does not give them license to recast estimates, projections, rounded-up numbers, or aspirational profits as lienable amounts.

Overbilling disrupts this balance. When a contractor inflates hours, pads material costs, bills for items never delivered, or assigns arbitrary figures to “extras,” the lien no longer reflects the actual improvement to the home. It becomes a distorted account of a transaction that never occurred. Colorado courts have long recognized that liens based on knowingly exaggerated or false claims cannot stand, because an excessive lien misstates the contractor’s contribution to the property and abuses a statutory remedy reserved for legitimate claims.

The statute itself can be reviewed at the Colorado General Assembly’s website: https://leg.colorado.gov/.

How Overbilling Actually Appears During a Construction Project

Overbilling rarely appears as a single problematic line item on an invoice. Instead, it emerges gradually, and homeowners often experience it as a shift in the contractor’s behavior. A month earlier, the contractor may have provided detailed invoices, but as friction increases, documentation stops arriving. Where earlier bills itemized labor and materials, new invoices simply assert totals. Materials the homeowner never saw arrive are suddenly claimed as delivered. Labor hours increase even as the crew appears less frequently on the job.

Sometimes the contractor insists that unexpected conditions justified additional costs, but the contract required written change orders—and none exist. Other times, the contractor charges for work that was actually correcting their own mistakes, even though a homeowner is never required to pay for redoing defective work. In more serious cases, invoices claim hours for days no work was performed or list materials the job never required.

Patterns of overbilling almost always appear alongside other forms of underperformance. That is why inflated invoices frequently show up in cases involving incomplete work, which we explore in What to Do When a Contractor Files a Lien for Incomplete Work, and in cases involving unauthorized scope changes, examined in Can a Contractor File a Mechanic’s Lien for Work Not in the Contract?. By the time overbilling becomes obvious, the project often already contains defects or deviations from the contract.

Why Overbilling Weakens or Destroys a Contractor’s Lien Rights

The validity of a mechanic’s lien depends on the accuracy of the amount claimed. A contractor may not inflate the lien to improve negotiation leverage, mask earlier mistakes, or recover losses caused by mismanagement or defective work. When a lien amount is exaggerated, it ceases to be a lawful “just and true account” of what is owed.

Courts treat inflated liens with skepticism. Some reduce the lien to the amount that can be substantiated. Others reject the lien entirely when the inflation is substantial, intentional, or part of a broader pattern of improper conduct. In many cases, overbilling is viewed not as an innocent error but as evidence that the lien was filed in bad faith. Under those circumstances, a homeowner may be entitled to attorney fees or damages for slander of title.

Because inflated billing usually intersects with other deficiencies—such as lack of substantial performance, unlicensed work, or abandonment—the lien rarely survives careful scrutiny. These issues are discussed further in Can a Contractor File a Mechanic’s Lien After Abandoning the Job? and Can an Unlicensed or Non-Permitted Contractor File a Mechanic’s Lien?.

Why Contractors Who Inflate Invoices Often Miss the Lien Requirements Too

Overbilling typically appears in projects that have already lost structure. Documentation is lacking, schedules have slipped, communication has deteriorated, and the contractor is improvising on costs. In that environment, procedural compliance with the lien statute is often overlooked. Contractors who struggle to maintain accurate billing frequently also:

miss the statutory deadline for recording the lien,

fail to properly verify the lien under oath,

misidentify the property or the owner, or

include non-lienable charges such as penalties, cleanup fees, or speculative future work.

Because the lien statute requires strict compliance, any one of these defects can be fatal. Homeowners evaluating these issues may want to review How Long Does a Contractor Have to File a Mechanic’s Lien? for an understanding of how timing interacts with lien validity.

How Homeowners Can Respond When a Lien Is Based on Inflated Billing

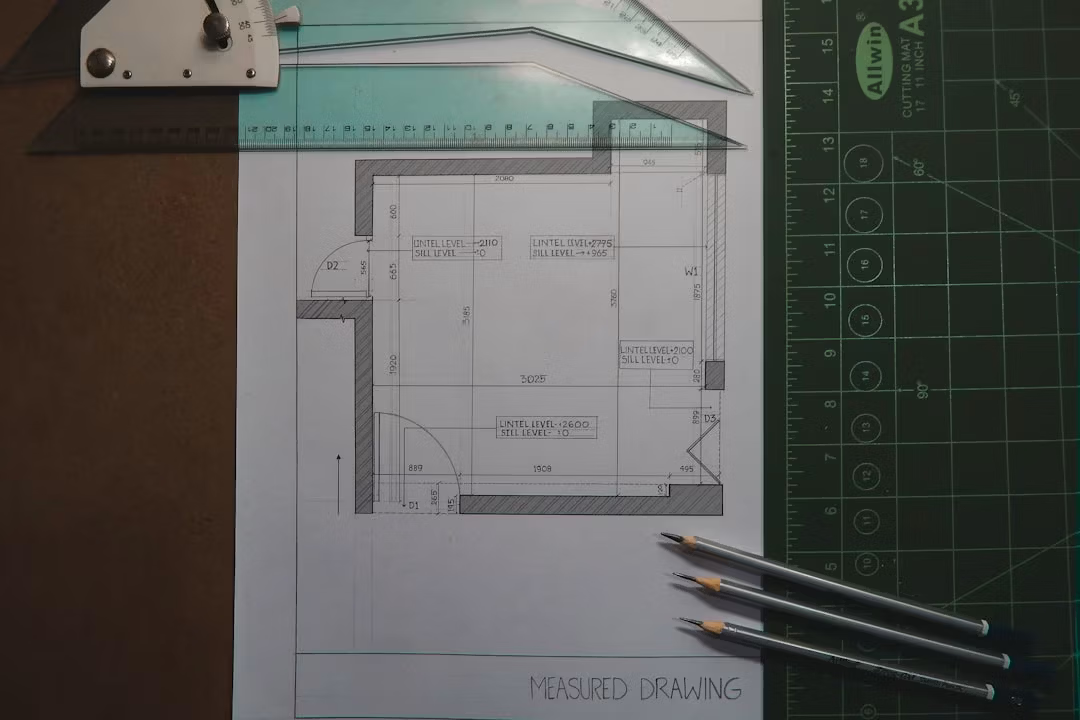

When facing an inflated lien, the homeowner’s best tools are documentation and clarity. Reviewing the contract, payment schedule, and all communications helps identify where the invoicing departed from the agreement. Comparing billed labor to the days workers were present, or billed materials to actual deliveries, often makes disparities obvious.

Photographs of the work performed may reveal that the contractor billed for progress that never occurred. Supplier invoices can confirm whether the contractor ever purchased what they claimed. In many cases, an independent contractor or estimator can evaluate the project and identify where the billing exceeds the value of the work.

Where a sale or refinance is threatened, homeowners may need to remove the lien from title before the dispute is resolved, often by using Colorado’s process for bonding around a lien. That procedure is explained in How Colorado Property Owners Can Bond Around a Mechanic’s Lien.

Why Legal Representation Makes a Critical Difference in Overbilling Disputes

Contractors who submit inflated invoices and follow them with a mechanic’s lien have already signaled they intend to use statutory pressure to collect payment. These are not simple accounting disagreements; they are disputes about performance, honesty, and contractual rights.

A Colorado construction attorney can evaluate the lien’s validity, calculate the true value of labor and materials, and assert claims for breach of contract or defects that often outweigh the contractor’s demands. Many inflated-lien cases end not with the homeowner paying the contractor but with the contractor returning funds or facing liability for defective work.

Once the numbers are analyzed and the law applied, inflated liens usually collapse. What feels at first like an overwhelming threat often becomes an opportunity to surface the truth about the contractor’s conduct and resolve the dispute on the homeowner’s terms.

Have Questions About Mechanics Liens?

Our experienced construction defect attorneys are here to help. Schedule a free 15-minute screening call to discuss your situation.